Waste to Wealth: Critical Material Recovery from Secondary Sources

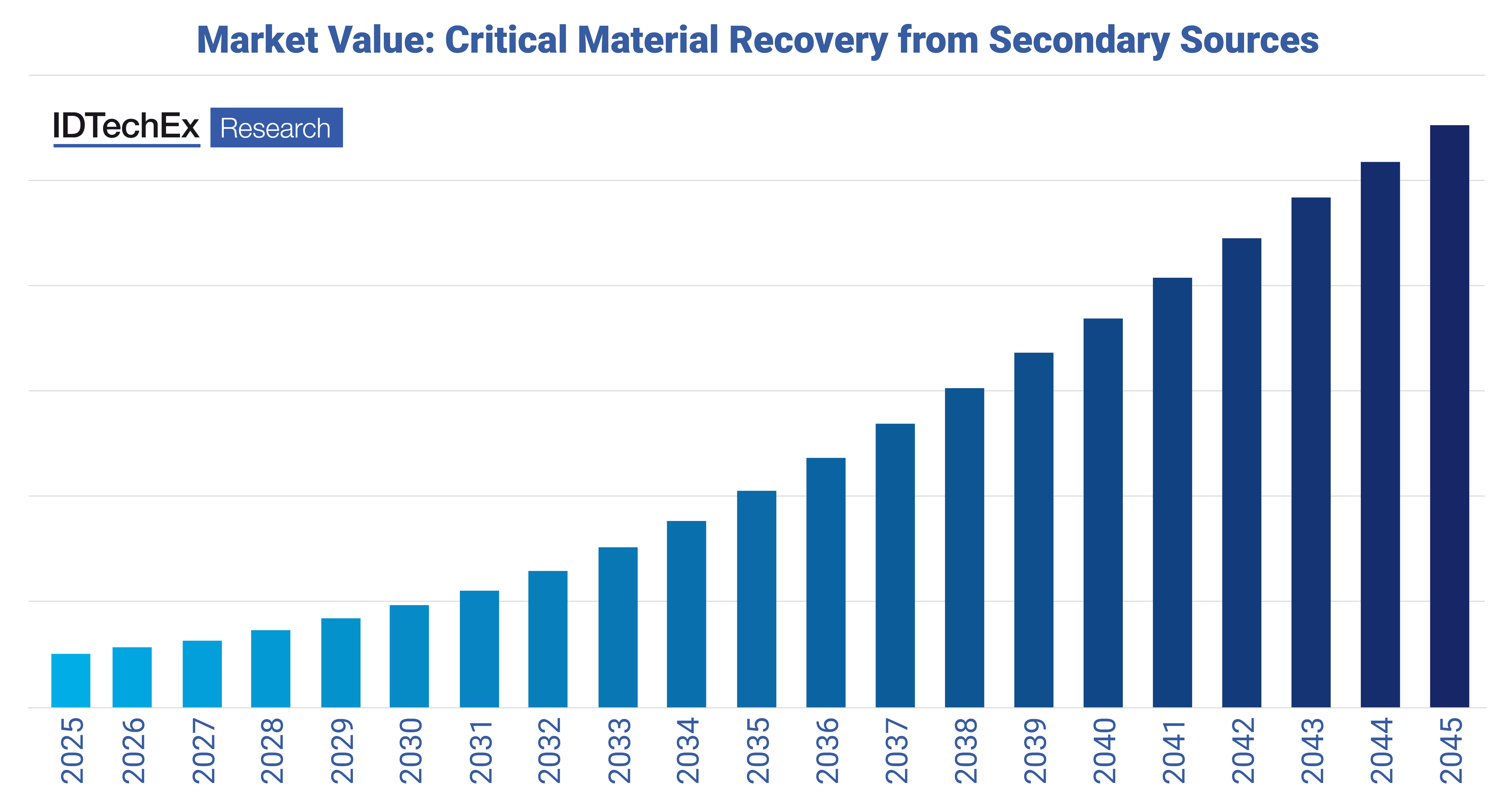

IDTechEx Forecasts US$110B Worth of Critical Materials Recovered Annually by 2045

Author: Dr Jack Howley, Technology Analyst at IDTechEx

End-of-life equipment from automotives, electric vehicles, e-waste and decarbonized energy technologies are rapidly emerging secondary raw material sources for valuable critical materials. IDTechEx’s new report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players”, forecasts that US$110B of critical materials will be recovered annually from secondary sources by 2045, with a combined weight of over 3.3 million tonnes. Secondary source critical material recovery technologies, markets, key players, and evolving value chains are characterized in this report. Technical innovations are explored across four prominent critical material segments, including lithium-ion battery technology metals, rare-earth elements, platinum group metals, and semiconductors. IDTechEx predicts that the critical material recovery market will grow at a CAGR of 12.7% from 2025-2045.

Annual value of critical material recovery market from 2025-2045. Source: IDTechEx

Critical material recovery from secondary sources looks to alleviate growing global material supply risks and their impact on regional economies. Critical materials, such as lithium, nickel, cobalt, rare-earths elements, platinum group metals, silicon, and other semiconductors underpin all modern technology. However, the high geographical localization of critical material market supply chains – both primary critical mineral deposits and processing steps – presents major risks to many global economies. These factors are creating a strong market pull for critical material recovery technology that utilizes secondary raw materials as an alternative to primary sources.

Fortunately, secondary raw materials are compelling sources for critical material recovery. Global megatrends in mass digitalization across consumer, transport, energy, communication, and industrial sectors have consolidated large volumes of critical materials into devices and equipment. The result of this is that the content of critical materials in anthropogenically derived sources is often higher than in primary mineral deposits. As the volume of critical material containing equipment reaching end-of-life increases year-on-year, the secondary source stream for critical material recovery becomes ever more valuable. IDTechEx’s report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players”, evaluates the critical material market, analyzing the content of key secondary sources and forecasting the volume of secondary raw materials recoverable by 2045.

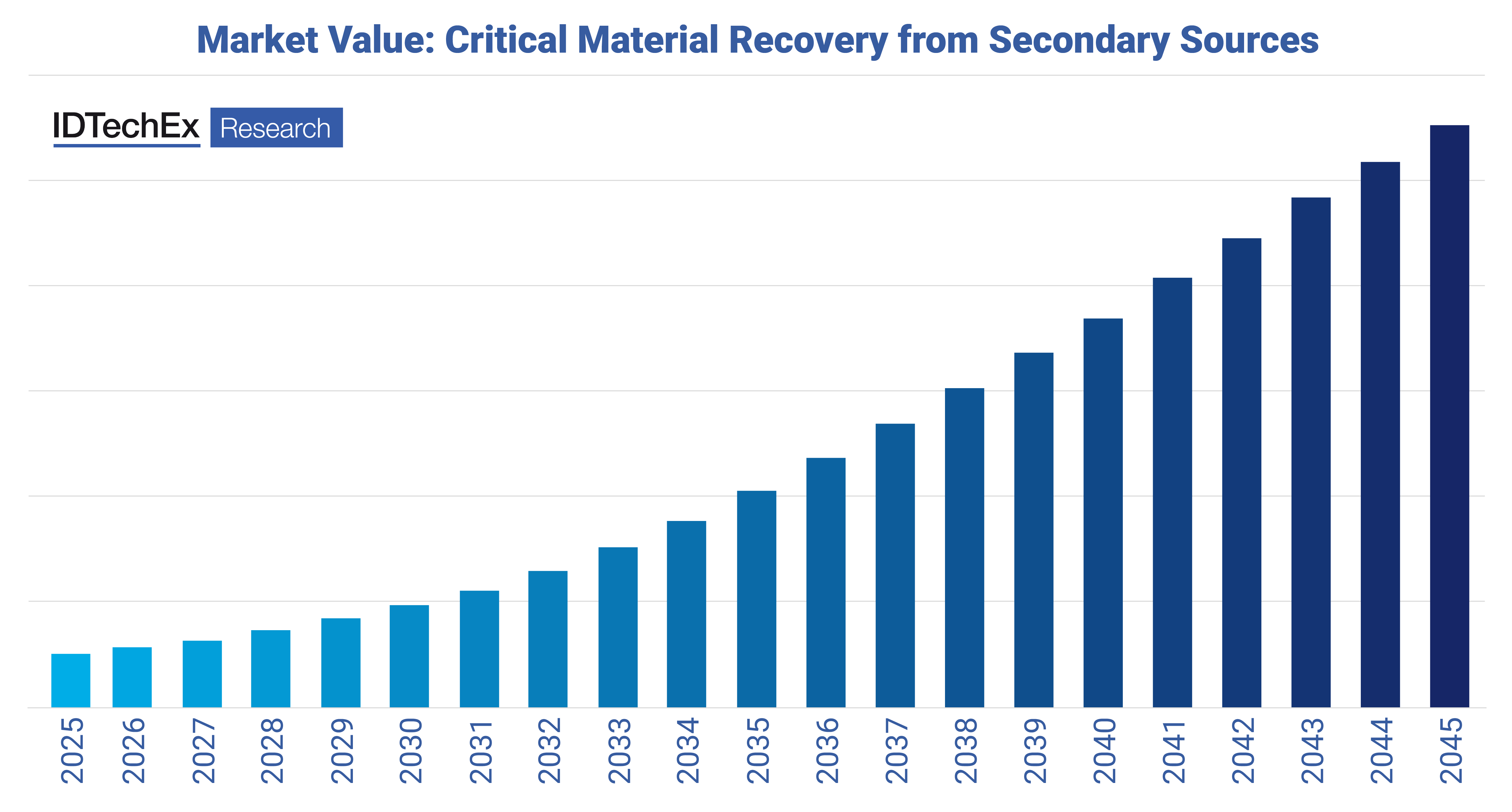

Critical material extraction and recovery technologies and key critical material market segments covered in the report. Source: IDTechEx

Critical material recovery technologies are largely ready to go; it is just a question of how easily they may be repurposed for secondary material sources. Critical material extraction and recovery technologies pioneered for primary mineral processing are scalable with high recovery efficiency, making them well-positioned for deployment in secondary source streams. A major challenge in deployment remains adapting the processes to the distinct composition of secondary materials, which contain complex mixtures of critical materials with plastics, adhesives, films, low-value metals, and inorganic material. This report evaluates 13 critical material extraction and recovery technologies, providing case studies on their commercial application in secondary sources.

Looking forward, critical platinum group metal (PGM) recovery from secondary sources will dominate market value share in 2025, but Li-ion battery technology metal and rare-earth element markets will emerge rapidly thereafter. The high market value of palladium, platinum, and rhodium and their high density in automotive scrap has defined the established PGM secondary source market for decades. However, growing consolidation of critical materials in decarbonized energy and transport technologies will drive a significant value transfer into their associated applications. As large volumes of electric vehicles reach their end-of-life by 2045, lithium, nickel, cobalt, and manganese from batteries and rare-earth elements from drive motor magnets will emerge to represent the overwhelming majority of recoverable value.

The new IDTechEx report, “Critical Material Recovery 2025-2045: Technologies, Markets, Players”, leverages IDTechEx’s extensive cross-discipline expertise in critical advanced materials, sustainability, and recycling technologies. The analyst team builds on decades of experience covering emerging technology markets dependent on critical materials, including batteries, energy storage, electric vehicles, the hydrogen economy, and semiconductors.

This report provides market intelligence about critical material recovery technologies for four key secondary source segments. It also characterizes globally identified emerging critical materials and the associated emerging secondary source recovery opportunities. This includes:

A review of the context and technology behind critical material recovery from secondary sources

- History and context for each extraction and recovery technology with respect to both primary and secondary source critical materials.

- General overview of important technologies emerging for secondary source critical material recovery.

- Critical technical evaluation, benchmarking, and comparison throughout.

- 15 SWOT analyses of critical material extraction and recovery technologies, including hydrometallurgy, pyrometallurgy, ionic liquids, solvent extraction, ion exchange, and direct recycling technologies.

- Discussion on the evolving value proposition presented by key critical material recovery technologies for secondary sources.

Full market characterization of critical material recovery technology in key secondary source segments

- Extensive characterization of critical material market segments, including rare-earth elements, lithium-ion battery technology metals, semiconductors, and e-waste market, and platinum group metals.

- Identification of key growth opportunities within secondary source markets for critical material recovery.

- Key player and business model analysis.

- Evaluation and market mapping of value/supply chains.

- Critical market evaluation using case studies featuring commercial successes and shortcomings for each critical material technology segment.

Market analysis throughout

- Reviews of critical material recovery players throughout each key sector, including 25 company profiles.

- 20-year market forecasts from 2025-2045 for four secondary source critical material recovery technology areas, including full narrative, price assumptions, limitations, and methodologies for each.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/CriticalMaterials.

For the full portfolio of sustainability market research available from IDTechEx, please see www.IDTechEx.com/Research/Sustainability.