Sodium-ion: The Battery Built for Trade Resilience, Reports IDTechEx

Author: Shazan Siddiqi, Senior Technology Analyst at IDTechEx

Amidst rising tariffs, geopolitical tensions, and growing restrictions on battery material exports, the case for a resilient, domestically anchored battery industry has never been stronger. Sodium-ion technology, leveraging abundant and locally sourced materials, is emerging as a compelling alternative to lithium-ion, particularly in light of critical mineral bottlenecks and trade volatility.

IDTechEx's report, “Sodium-ion Batteries 2025-2035: Technology, Players, Markets, and Forecasts“, provides a comprehensive analysis of this rapidly advancing sector. It assesses market potential, commercial readiness, and the materials landscape, emphasizing sodium-ion's alignment with industrial strategies aimed at achieving energy independence. The report identifies earth-abundant materials such as sodium, iron, and manganese as key enablers of localized supply chains.

The trade challenge for lithium-ion

The lithium-ion battery market faces mounting pressures from escalating trade conflicts. In the U.S., new tariffs on battery imports now range from 54% to over 100%, directly impacting grid-scale storage projects, EV affordability, and broader energy independence goals. These challenges expose strategic vulnerabilities in relying on foreign-controlled supply chains.

Sodium-ion: Abundant, secure, and scalable

Sodium-ion technology offers a supply chain advantage by avoiding reliance on geopolitically sensitive materials. Sodium is widely distributed, especially along coastlines, and is significantly cheaper than lithium. Unlike lithium, sodium can be sourced without dependence on concentrated mining operations in politically volatile regions. The U.S., for example, holds substantial reserves of soda ash (sodium carbonate), offering a natural advantage in sodium-ion cell production.

Built for stationary storage

Sodium-ion development is driven not only by lithium price volatility, but also by its thermally stable, non-flammable chemistry and rapid intercalation capability. These attributes make sodium-ion ideal for grid-scale storage, where energy density is less critical than reliability, safety, and resilience under demanding operating conditions. With increasing strain on aging grid infrastructure and surging data centre demand, sodium-ion provides a robust technical fit. IDTechEx research finds that under 300 MWh grid-scale sodium-ion batteries have already been installed across Chinese projects as of Q1 2025, with more under construction.

Global momentum and commercialisation

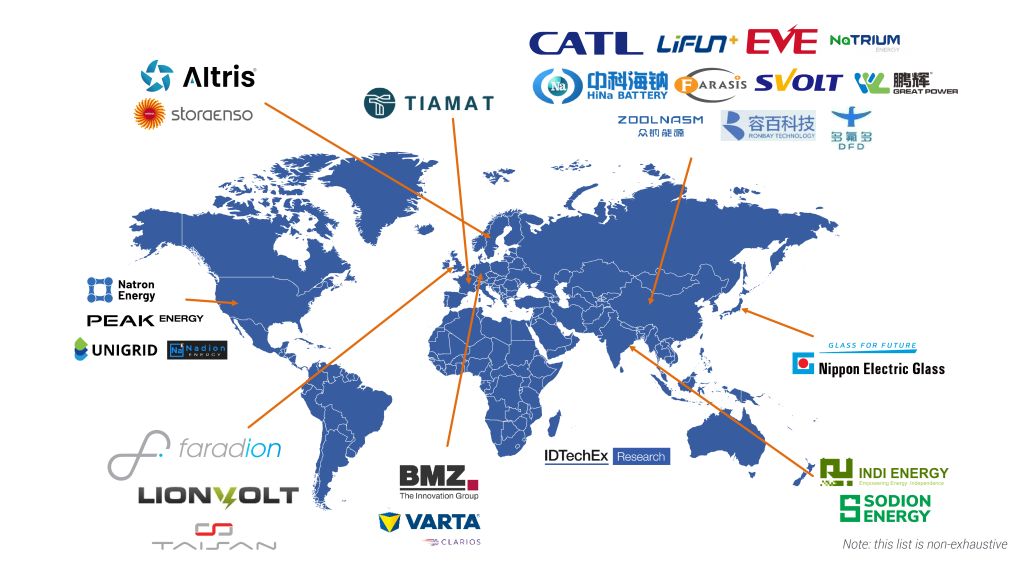

While scepticism remains, leading manufacturers like CATL and BYD are rapidly scaling sodium-ion deployment, particularly in segments overlapping with LFP – a replay of LFP's early dismissal and eventual dominance. Sodium-ion now stands at a similar inflection point. The IDTechEx report forecasts global sodium-ion battery demand reaching just over 90 GWh by 2035. Meanwhile, U.S.-based innovators such as Unigrid and Peak Energy are advancing key components across the value chain, from anodes to system-level designs.

China will dominate sodium-ion cell manufacturing while the West will focus on material innovation, pack and system-level integration, and scaling domestic production capabilities to support localized energy storage markets. Source: IDTechEx

Pathways to domestic production

Though sodium-ion cells are primarily produced in China today, near-term U.S. BESS projects will likely rely on Chinese cell supply for cost and scale advantages. However, companies that leverage these capabilities while investing in domestic supply chains will be best positioned for long-term competitiveness. Building a fully integrated U.S. sodium-ion ecosystem will require time, capital, and workforce development, but the strategic payoff is substantial.

As nations race to establish battery supply chains that are secure, sustainable, and scalable, sodium-ion stands out as a technology being pursued not only for performance or cost reasons but also for resilience. With broad material availability, low geopolitical exposure, and growing commercial traction, sodium-ion represents a critical path toward energy independence and supply chain diversification.

To find out more about IDTechEx's “Sodium-ion Batteries 2025-2035: Technology, Players, Markets, and Forecasts” report, including downloadable sample pages, please visit www.IDTechEx.com/Sodium.

For the full portfolio of energy storage and batteries market research available from IDTechEx, please see www.IDTechEx.com/Research/ES.