Retail Returns – New Mall Supply to Double to 10.15 Mn sq. ft. in 2022 Pan-India

- otal number of 15 new malls to enter the market this year spread across 12 cities in the country; Chennai to see highest supply of 4 new malls this year spread over 2.55 mn sq. ft.

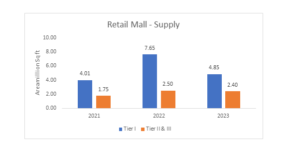

- Tier 1 cities with new mall supply include Ahmedabad, Chennai, Bangalore, Hyderabad, Mumbai, Pune & Ghaziabad in NCR spanning 7.65 mn sq. ft. area; Tier 2 & 3 cities include Baroda, Budaun, Indore, Nagpur & Udaipur with remaining 2.50 mn sq. ft. area

- In 2021, India saw new mall supply of approx. 5.76 Mn sq. ft., of which 70% was in Tier 1 cities and 30% in Tier 2 & 3 cities

- In 2023, approx. 7.25 Mn sq. ft. of new mall supply spanning 16 new malls will hit the market across the country – 67% area in Tier 1 cities, 33% in Tier 2 & 3 cities

- Tier 1 cities include Bangalore, Chennai, Gurgaon (NCR), Hyderabad, Mumbai & Pune while tier 2 & 3 cities include Bhopal, Cuttack, Jamshedpur, Kochi, Lucknow & Vizag

Retail real estate is staging a strong comeback, with nearly 10.15 Mn sq. ft. of new mall supply set to hit Tier 1, 2 and 3 cities in 2022, and another 7.25 Mn sq. ft. in 2023. In 2022, new mall supply will be almost twice that of 2021, when approx. 5.76 Mn sq. ft. of new retail real estate supply entered the country.

As many as 15 new malls will enter the market in 2022 spread across 12 cities in the country. Chennai will see the highest supply of four new malls this year spread over an area of 2.55 mn sq. ft.

Other tier 1 cities with new mall supply include Ahmedabad, Bangalore, Hyderabad, Mumbai, Pune and Ghaziabad in NCR spanning 5.10 mn sq. ft. area. Tier 2 & 3 cities include Baroda, Budaun, Indore, Nagpur and Udaipur with total area of approx. 2.50 mn sq. ft.

COVID-19 severely impacted the general economy – and retail in particular – in 2020. Brick-and-mortar retail stores in malls and high streets were hit hard, and a quick recovery seemed improbable.

“In the course of two severe waves that saw massive restrictions forced on malls, operators had to rethink their business plans and strategies,” says Pankaj Renjhen, COO & Jt. MD – ANAROCK Retail. “However, the massive nationwide vaccination drive resulted in a much milder 3rd wave at the beginning of 2022 – and the withdrawal of restrictions allowed economic activities to restart. This has fuelled new growth in the retail sector.”

As consumers return to more normal shopping and socializing patterns and populate malls again, India’s retail real estate market is responding to significantly improved footfalls. Malls are again witnessing high occupancy levels, and the requirement for more organized retail space is pronounced.

Going by the high leasing volumes by occupiers across categories and the momentum witnessed in the Tier II & III cities, mall developers are finishing their projects and rapidly adding new inventory.

“While 2020 was a washout year with new mall supply of just 2.1 million sq. ft. in tier I cities, it nearly doubled to 4.01 million sq. ft in 2021,” says Pankaj Renjhen. “The performance of most malls in key consumption centres has either surpassed pre-pandemic levels in February 2020 or inched closer to those thresholds.”

Tier II & III cities are witnessing rapid mall penetration. The supply in these cities in the current year is close to 2.5 million sq. ft., recording a yearly growth of 91%. The cities include Baroda, Budaun, Indore, Nagpur and Udaipur.

These cities have seen considerable growth in disposable income, mobile internet penetration, and support infrastructure. Consumers in tier II and Tier III cities now show an apparent propensity for branded products, which sets the stage for accelerated growth of organized retail across the country.

The pandemic-infused ecommerce boom cannot be wished away and continues to be patronized by some segments of society. However, the upcoming supply of mall spaces – clearly in response to increased demand – proves that physical retail remains the dominant force in India.

COVID-19 led to significant advancements, technological adaption, and a fresh burst of innovations in the retail sector as retailers respond to evolving consumer requirements. The result is omnichannel retail, which offers a new balance between convenience and experiential shopping – and has also boosted the demand for offline premises.