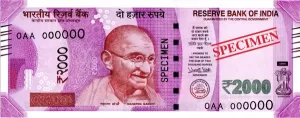

Rs. 2000 Note Withdrawal – Not a Housing Deal-breaker

Akash Pharande, Managing Director – Pharande Spaces

The Reserve Bank of India’s decision to withdraw Rs 2,000 currency notes from circulation has raised questions about its potential impact on the housing sector. Some believe that the move may lead to a rise in land deals and resale housing transactions with cash components, at least in the short-term while the shock lasts.

Others argue the impact will be minimal, especially on the primary housing sales market. The biggest doom-sayers remind us of the impact of the government’s demonetization of the then-existing Rs. 500 and Rs. 1000 notes on the real estate market.

DeMo 2016 Vs Rs. 2000 Note Withdrawal 2023

DeMo 2016 – No doubt, the 2016 demonetization led to a not-so-short-term decline in property transactions and a slowdown in the housing sector. The Indian real estate market had almost traditionally involved a significant amount of cash transactions, invariably involving unaccounted and hoarded high-value currency notes. With the withdrawal of these notes, there was a cash shortage in the market, leading to a decrease in property sales and a drop in prices.

The liquidity crunch also affected real estate developers who relied on cash transactions for land acquisitions and construction. The sudden withdrawal of the then very prevalent Rs. 1000 and Rs. 500 notes disrupted their cash flow, leading to delays in project completions and financial stress.

Demonetization also psychologically impacted homebuyers and housing investors, causing them to adopt a wait-and-watch approach. Uncertainty prevailed in the market, as people needed clarification about the long-term effects of the policy. This cautious sentiment further contributed to a slowdown in the real estate sector.

Also, the impact of demonetization on the real estate market was hardly uniform across the country. The effects were more pronounced in markets where cash transactions were more prevalent, such as in smaller cities and rural areas. In the bigger, more organized real estate markets where a high proportion of property transactions were already happening via official banking channels, the effect of DeMo was much less.

2023 – This year, the RBI has decided to withdraw Rs 2,000 notes from circulation. First, this withdrawal is not a cataclysmic event but a gradual process. It is not a ban. These notes have not been demonetized and will continue to be legal tender. The RBI has asked citizens to deposit or exchange these notes by September 30, 2023.

This is obviously not comparable to the 2016 event, which was abrupt and had almost no buffer period. Also, many things have changed in the Indian real estate sector since the highly disruptive demonetization. The cash component in housing transactions has reduced massively.

Impact of Similar Moves in Other Countries

It can’t be denied that the sudden withdrawal or demonetization of currency notes had undoubtedly negatively impacted the real estate markets of other countries. In 2016, Venezuela demonetized its 100 bolivar note, which accounted for around 77% of the country’s cash in circulation. This created chaos and adversely affected the country’s real estate market, as property transactions stalled, prices declined, and liquidity tightened.

In 2019, Zimbabwe banned using foreign currencies and reintroduced its national currency, the Zimbabwean dollar. As a result, the country experienced hyperinflation and economic challenges, and the withdrawal of foreign currencies affected its real estate market. Property values declined, and transactions plummeted.

Long before that, in 1987, the Burmese government demonetized the 25, 35, and 75 kyat notes. Again, this move aimed to tackle inflation and corruption but also led to a decline in property prices, transactions, and overall investment in the sector.

However, it makes little sense to use such yardsticks; the impact of demonetization or withdrawal of currency notes in one country cannot be gauged by what happened in other countries. Each country has its specific circumstances and market conditions. No doubt, the markets were thrown into chaos wherever there was a high reliance on cash transactions in real estate.

But even though the Indian real estate market took a hit in 2016, it has changed hugely since then.

A survey by LocalCircles indicates that cash transactions in Indian real estate have reduced since demonetization and continue to reduce. In the 2021 survey, 70% of respondents admitted to cash as part of the transaction for property acquired in the previous 7 years.

However, a more recent survey showed that 44% of respondents who bought a property in the last 7 years said cash was part of the transaction. The percentage of respondents who admitted to having paid over half of the amount in cash dropped from 16% in 2021 to 8% in the new survey.

This indicates that the Indian housing sector has transformed hugely since 2016. It is not just that RERA requires complete transparency accountability – buyers and sellers have consciously moved away from cash components.

There may continue to be instances in tier 3 cities where amateur builders sell flats to buyers outside the purview of RERA, with cash components of varying magnitudes. Still, the influence of and awareness about the revolutionary RERA Act is spreading rapidly.

Most Indian homebuyers are end-users who want their purchases to be well-documented and legally above board. On their part, with the possible exception of minor bit players with small one-off projects in tier 3 and peri-urban areas, developers will not risk engaging in business practices that impact their business reputation and sustainability.

Therefore, the graded Rs. 2000 note withdrawal will not hit the first sales market involving developers and homebuyers. However, the resale market may take a slight hit because cash components continue to happen there. Whatever impact is seen will not extend beyond the end of 2023.

About the Author:

Akash Pharande is Managing Director – Pharande Spaces, a leading real estate construction and development firm famous for its township projects in West Pune and beyond. Pharande Promoters & Builders, the flagship company of Pharande Spaces and an ISO 9001-2000 certified company, is a pioneer of townships in West Pune.