IDTechEx Looks at Why Sustainable Helium Use is Needed to Future-Proof the Semiconductor Industry

Author: Dr Shababa Selim, Technology Analyst at IDTechEx

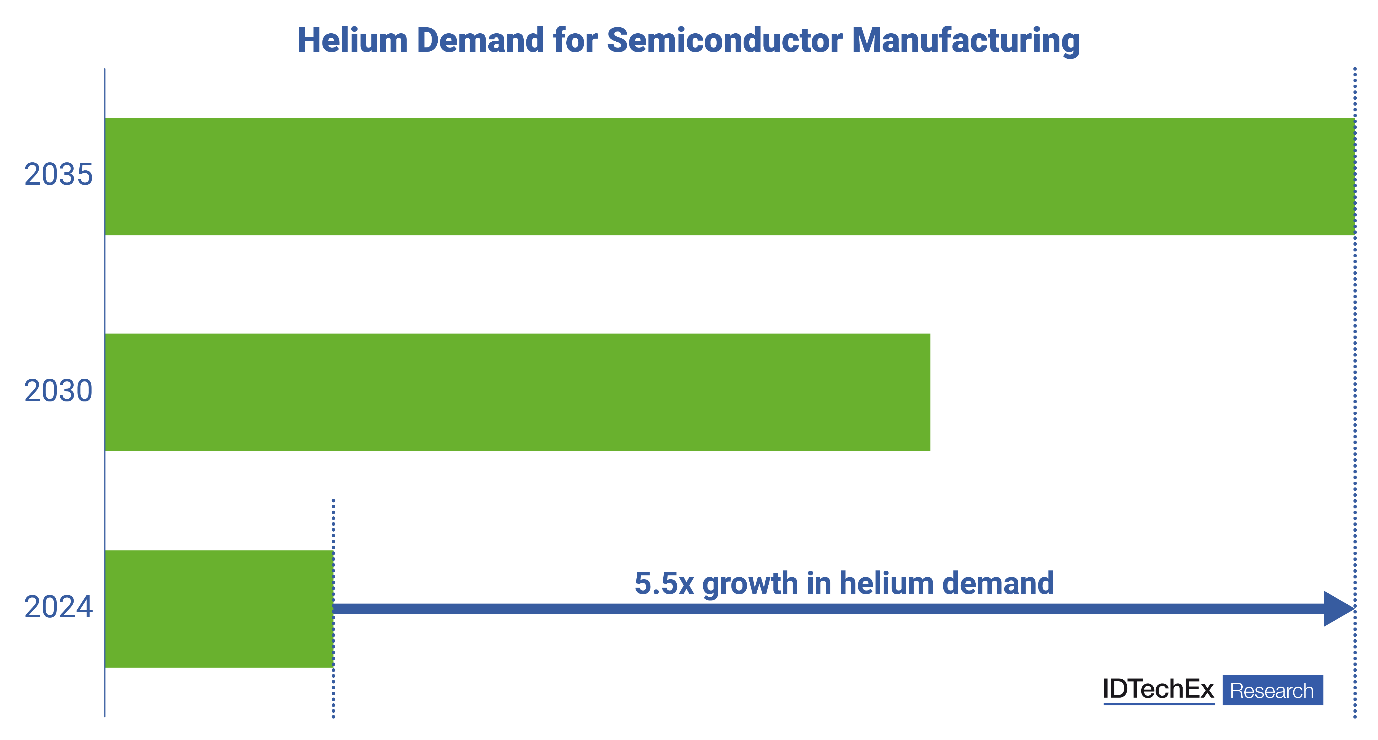

Semiconductor manufacturing processes require many chemicals and specialty gases. Owing to its cryogenic properties, exceptional thermal conductivity, chemical inertness, and high diffusivity, helium is used throughout the semiconductor manufacturing line, particularly for wafer cooling where there are no viable alternatives. Given the US Chips Act, EU Chips Act, and several other government initiatives worldwide to boost the semiconductor industry, IDTechEx predicts the helium demand for semiconductor manufacturing will increase by over five-fold by 2035 in their latest report, “Helium Market 2025-2035: Applications, Alternatives, and Reclamation”. With helium being a finite resource, questions remain on how this will impact the sustainability of the semiconductor manufacturing industry.

IDTechEx forecasts helium demand for semiconductor manufacturing to grow over five-fold by 2035. Source: IDTechEx

Advancing smaller nodes requires more helium

Among gases, helium's exceptionally high thermal conductivity combined with its chemically inert nature is second to none. It allows the fast cooling of chips during the manufacturing process. Furthermore, with semiconductor technologies advancing toward smaller nodes, the need for effective thermal management during manufacturing processes is increasing the reliance on helium for semiconductor miniaturization. Demand from AI, quantum computing, telecoms, sensors, electric vehicles, and automation in the automotive industry are all projected to be significant drivers for growth in semiconductor manufacturing and, hence, helium use.

Navigating chronic helium supply shortages

Over the last twenty years, the helium market has been subject to chronic supply challenges and price volatility resulting from geopolitical tensions, unexpected plant outages, and maintenance downtimes of helium production and processing plants. Furthermore, the difficulty in storing helium over prolonged periods means that semiconductor manufacturers have resorted to reducing their production rate to manage helium use during periods of helium shortage. Although helium production capacity is anticipated to increase with Qatar and Russia expected to ramp up production, it does not necessarily guarantee a disruption-free helium supply moving forward when considering geopolitical tensions in regions where helium is largely produced. Additionally, according to the United States Geological Survey, the current estimate for total global helium resources is ~40 billion cubic meters. Considering the average annual production rate (2017-2023), approximately ~250 years of helium is available in reserves. With the increasing demand mentioned, this supply could run out much sooner, therefore, sustainable management of this finite resource should be a key consideration for industries critically reliant on helium.

Helium recycling trends in other industries can pave the path for adoption in semiconductor manufacturing

With helium being a finite resource and critical for several applications, including semiconductor and fiber optic manufacturing, leak testing of lithium-ion batteries and aerospace components, cryogenic applications, and many more, helium conservation and management will need to play an increasingly important role in manufacturing industries. IDTechEx’s report on the topic looks at the growing rate of adoption of helium recycling in other industries, including fiber optic manufacturing, leak testing components (e.g., HVAC, aerospace, automotive), and also cryogenic applications (e.g., MRI and NMR systems), primarily driven by price volatility and supply challenges.

While the deployment of industrial reclamation for specialty gases is currently negligible, with constraints on the supply of specific gases and increasing prices (e.g., neon, helium, etc.), the capital cost of adopting reclamation systems may become more feasible and increasingly feature in new semiconductor fabs.

IDTechEx’s outlook

Although expansions of helium production capacity may help ease some of the supply challenges associated with the helium market, geopolitical tensions in regions where helium is largely produced still leave questions unanswered regarding the future of supply security. IDTechEx forecasts the helium demand for semiconductor manufacturing will increase by over five-fold by 2035. To meet the growing demand, the semiconductor industry will not only need a stable supply of helium but will also need to invest in helium recycling and reclamation technologies to conserve helium and future-proof the sustainable growth of the industry.

IDTechEx’s latest report, “Helium Market 2025-2035: Applications, Alternatives, and Reclamation”, provides key market insights into the production and supply of helium, major applications, outlooks, and trends in how industries are adapting to cope with chronic supply challenges with helium conservation methods (e.g., reclamation technologies), or adopting substitutes where possible.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/Helium.

For the full portfolio of advanced materials market research available from IDTechEx, please visit www.IDTechEx.com/Research/AM.

Upcoming free-to-attend webinar

How Chronic Supply Challenges Are Reshaping Helium Use in Key Industries

Dr Selim, Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on the topic on Tuesday 24 September 2024 – How Chronic Supply Challenges Are Reshaping Helium Use in Key Industries.

The webinar will provide:

- An overview of global helium production and supply

- Impact of supply challenges on different industries e.g., semiconductors and fiber optics manufacturing, cryogenics, and several others.

- Technological advances to reduce helium consumption (e.g., MRI and NMR)

- Trends in the adoption of substitutes or reclamation systems

- Outlook for global helium production capacity and demand

We will be holding exactly the same webinar three times in one day. Please click here to register for the session most convenient for you.

If you are unable to make the date, please register anyway to receive the links to the on-demand recording (available for a limited time) and webinar slides as soon as they are available.