Emerging Haptic Actuators to Disrupt the Market, Says IDTechEx

Haptic feedback adds the dimension of touch to electronic devices. Most people will be familiar with haptic tech through their smartphone’s vibrate mode and rumble feedback in game controllers, but applications reach further. Haptics can improve safety in vehicles by tactile confirmation of virtual buttons being pressed, help make laptops thinner by removing the need for physical buttons from trackpads, and much more.

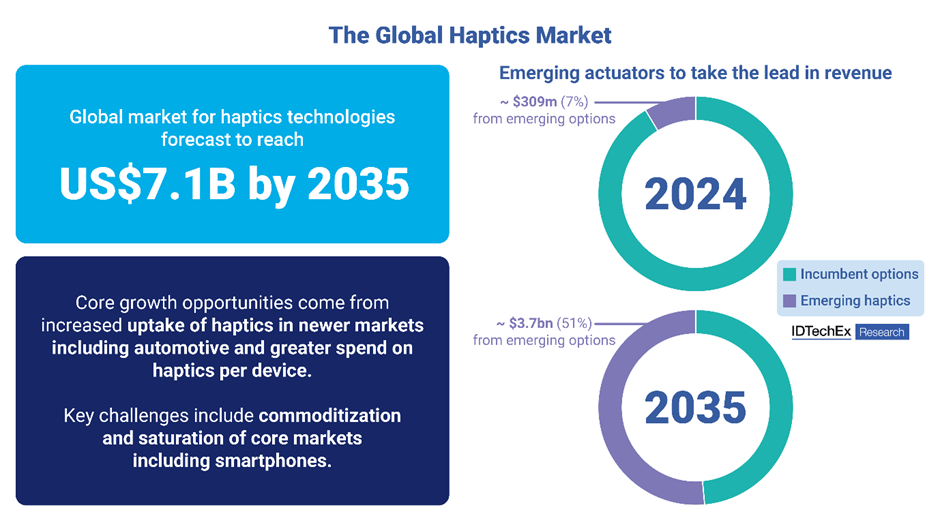

Haptics might fly under the radar, but they form a major industry that offers serious user experience benefits to consumers. IDTechEx’s recent report, “Haptics 2025-2035: Technologies, Markets, Players”, forecasts a US$7.1 billion market for haptic technology in 2035, with much of the growth in this market being fueled by the adoption of haptics in new classes of device.

The global haptics market. Source: IDTechEx

For most of the history of haptic tech, eccentric rotating mass (ERM) motors were by far the dominant technology used to deliver tactile feedback. Despite the low price of these components and their well-established prevalence over previous decades, linear resonant actuators (LRAs) began to take market share in the middle of the 2010s, to the point where they have now displaced ERM motors in many applications. Unlike ERM motors, LRAs decouple frequency from amplitude, expanding the range of sensations they can convey. They also deliver feedback along a single axis, giving more refined feedback.

However, the dominant status of LRAs has led to them approaching commoditization, with numerous suppliers and generally low prices. Another major factor behind IDTechEx’s US$7.1 billion forecast is the move from LRAs and ERMs to newer classes of haptic actuator in many applications where they can add value to user experience. These alternative actuators, primarily piezoceramic actuators and voice coil motors, are already used in smaller volumes, but the expectation of growing deployment is being driven by more emerging use cases for haptics.

Voice coil motors (VCMs), like LRAs, fall under the wider class of electromagnetic actuators but are designed to have reduced resonance by removing springs or reducing their restoring force. This allows them to be driven over a broader range of frequencies, increasing the range of haptic effects that can be conveyed, as well as helping to increase their acceleration for “clickier” feedback. This is a key reason for their early adoption in haptic audio, where perception of bass frequencies is enhanced by adding mechanical vibration. Haptic audio has been used in wearables from companies like Woojer and gaming headsets from companies including Corsair and Razer. Meta has also signaled its interest in the space through its acquisition of Lofelt, the German startup that designed custom VCMs for Razer’s headsets as well as providing haptic audio software.

Surface haptics in laptop trackpads provide a key driver for increasing adoption of VCMs but also a major competitor, piezoelectric actuators. Solid-state haptic trackpads, which make laptops slimmer while providing a more refined user experience, were first implemented in Macbooks using Apple’s Taptic Engine (a custom LRA). Their adoption in Windows PCs has been slower, but has started from the premium end of the market in the 2020s. This has tended to coincide with the choice of these more “premium” actuators.

Like VCMs, piezoelectric actuators also have a wide frequency response, but acceleration can be even higher to provide the most refined tactile experience. VCMs are likely to be lower-cost and require less complex driving circuitry since they are essentially speakers. Piezoelectric actuators shine particularly where there is a need to minimize actuator volume dominates, which makes them a great fit where localized feedback is needed, employing multiple actuators. This use case expands beyond trackpads to touchscreens, particularly in vehicles, where haptic input confirmation minimizes time spent with attention diverted from the road.

Haptic solid-state buttons with localized feedback would be the “killer app” for piezoelectric actuators. Not only could they provide a “crisper” button press feel than other actuators due to their super-high acceleration, but they can perform double duty as pressure sensors when paired with drivers from a company like Canadian player Boréas Technologies. This could allow smartphone camera buttons, like those included in the iPhone 16 range, to simulate the half-press to focus of a DSLR.

As the headwinds diminish for more emerging haptics technologies, with supply chains widening and engineering know-how around the use of new actuator classes improving, their utilization is expected to grow significantly. Although most emerging classes of actuator are unlikely to be able to compete with LRAs on pure price terms, their enhancement of user experience and cost offsets by elimination of other components in devices (e.g., solid state buttons) are expected to justify their use in many settings.

For this reason, IDTechEx’s report, “Haptics 2025-2035: Technologies, Markets, Players”, forecasts emerging actuators to exceed 50% of total haptics market share in 2035. This report is a valuable resource for helping to understand the evolving status of this market. It includes 10-year forecasting and market overviews, which focus on key application areas, including smartphones, gaming, VR, laptops, and vehicles. IDTechEx has been covering this market since 2015, and its network and overview of this exciting market is extensive.

To find out more about this report, including downloadable sample pages, please see www.IDTechEx.com/Haptics.

For the full portfolio of sensors, haptics and displays market research available from IDTechEx, please visit www.IDTechEx.com/Research/Sensors.