Electric Truck Milestones in 2023 and Outlook, Reports IDTechEx

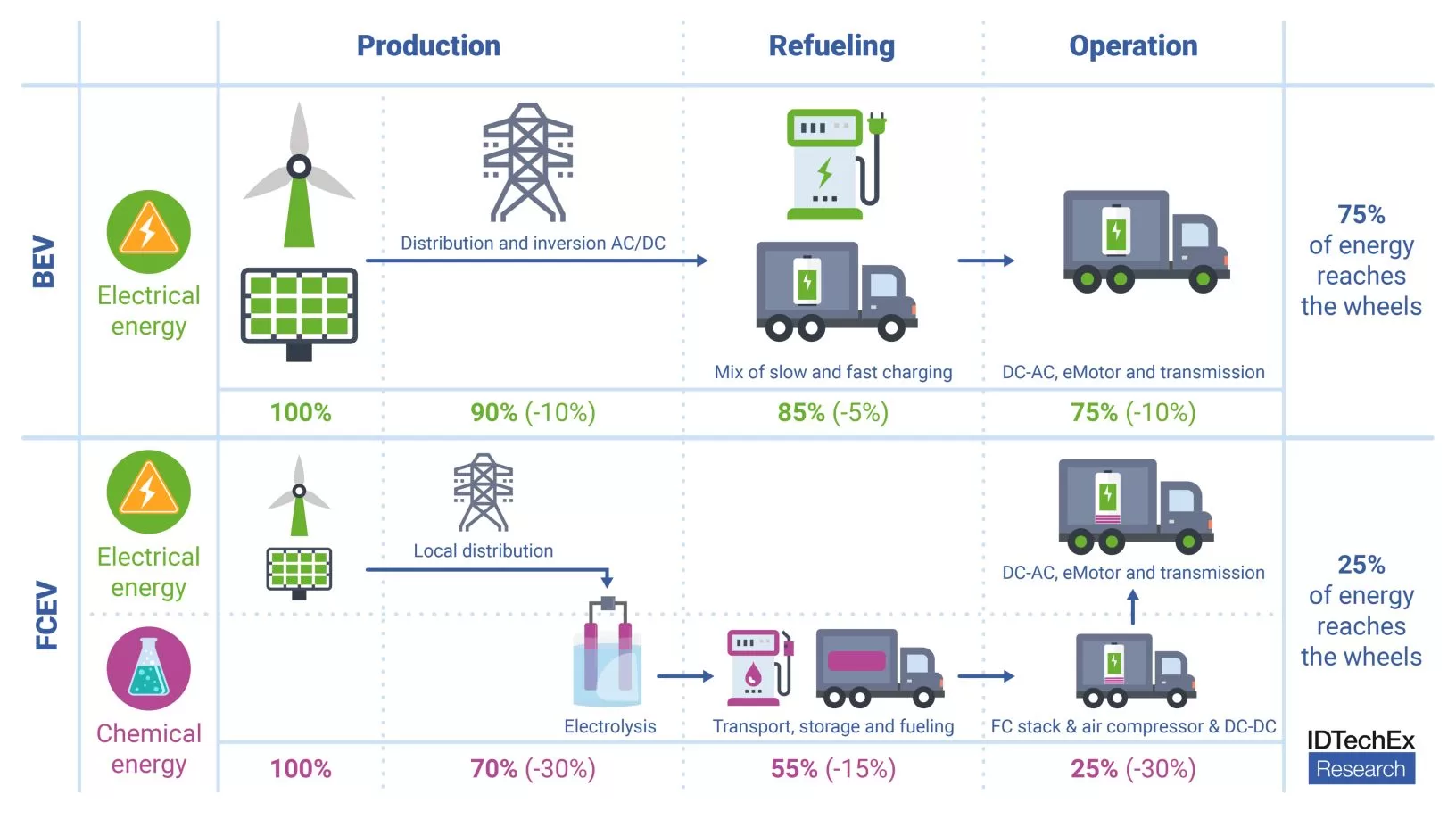

Author: Shazan Siddiqi, Senior Technology Analyst at IDTechEx Major fleets have committed to transitioning at least 30% of their new heavy-duty truck purchases to be zero-emission vehicles, including electric models, by 2030. However, many companies are daunted by the extra upfront cost of electric trucks, as well as challenges like the limited availability of chargers. The benefits of electric trucks, increased availability of more makes and models, investments in charging infrastructure, the rapid improvement of the upfront and long-term economics, and policy incentives all point to a near-term boom in their adoption. IDTechEx’s report, “Electric and Fuel Cell Trucks 2024-2044: Markets, Technologies, and Forecasts”, finds that the future of electric trucks hinges on continued innovation in battery technology, further expansion of charging and hydrogen refueling infrastructure, and acceptance of fuel cell trucks. Electric truck market regional highlights and outlook Electric truck sales shares remain low across most major markets. With the exception of China, Germany, and Netherlands, the cumulative electric medium- and heavy-duty truck sales to date number in the hundreds in most countries (just over 6000 electric trucks were sold across the entire EU+EFTA+UK regions in Q1-Q3 2023). Sales shares generally remain well under 1% in medium- and heavy-duty segments, with major shipping logistics companies running demonstrations of electric trucks in regional and long-haul electric operations. BEVs with plug-in chargers still dominate in China, but their market share has been in decline since 2020. Between January and June 2023, a total of 11,500 electric heavy-duty trucks were sold in China. Of these, 5,728 were battery-swap capable, taking up roughly 50% of the market share. IDTechEx research finds that battery swapping will remain a key technology pathway for heavy-duty trucks in China in the coming years. In the USA, improved models and infrastructure additions signaled a stronger electrification push in 2023. The single-charge driving range of various models was improved by increasing the number of battery packs and sticking to more energy-dense NMC and NCA chemistries. Furthermore, ten states have already signed up to the Californian ‘Advanced Clean Trucks’ regulation, which requires manufacturers to sell a gradually increasing proportion of electrically powered lorries, vans and pickup trucks by 2035. IDTechEx forecast that zero-emission trucks will take up 13% of the medium- and heavy-duty truck sales in the USA by 2030. New electric truck registrations in the EU surged by an impressive 321.7%, totaling 3,918 units in the first three quarters of 2023. Germany and the Netherlands were the main drivers of this growth, making up 65% of EU electric truck sales. Electric trucks now represent 1.5% of the market, significant progress from the previous year’s 0.4%. Volvo Trucks is the current market leader in battery-electric truck sales in Europe. Strong CO2 standards for trucks are needed to ensure frontrunners keep their promises and laggards catch up. Combined with the support for battery supply chains from the Inflation Reduction Act (IRA), the legacy US truck brands could quickly catch up and outpace European brands. Infrastructure for electric trucks took major but inadequate strides in 2023 Electric trucks have so far relied on off-shift charging for much of their energy. This is largely achieved at private or semi-private charging depots and often overnight. There is a global effort to scale up fast or ultra-fast charging as a prerequisite for making both regional and long-haul operations technically and economically viable. Commercialization of chargers with rated power of 1 MW will require significant investment, as stations with such high-power needs will incur significant costs in both installation and grid upgrades. Alternative solutions include installing stationary storage and integrating local renewable capacity, combined with smart charging, which can help reduce both infrastructure costs related to grid connection and electricity procurement costs. The IDTechEx report covers the MW charging player landscape and provides analysis of alternative charging strategies like overhead catenary, in-road dynamic wireless, and battery swapping. Slow uptake of hydrogen-powered fuel cell trucks The number of hydrogen-powered fuel cell electric trucks (FCETs) sold can still be counted on fingers and toes, but that number should grow in 2024 as players like Nikola, Toyota, Honda, Daimler, Volvo, and Hyundai are scaling their fuel-cell truck development plans. The partnership between Daimler and Volvo (Cellcentric) appears to be something of a hedge to cover bases if significant funding by governments in hydrogen production and infrastructure makes FCETs viable in the medium term. Nikola produced 42 hydrogen fuel-cell-electric trucks and has inked a 10-year strategic partnership with FirstElement Fuel to supply hydrogen. IDTechEx believes the fundamental issue with efficiency and production of green hydrogen will remain barriers to the wide uptake of FCETs. The latest report benchmarks various fuel cell trucks by power, consumption, and weight in addition to providing supply chain information.

|

||

|

Three times as much renewable electricity is needed to power a hydrogen truck compared to a battery electric truck. A great deal of energy is namely lost in the production, distribution, and conversion back to electricity. Source: IDTechEx Electric and Fuel Cell Trucks 2024-2044 |

||

|

The IDTechEx report, “Electric and Fuel Cell Trucks 2024-2044: Markets, Technologies, and Forecasts”, is designed to help businesses across the automotive industry plan for the future in this dynamic market. The report provides 80 forecast lines, giving a twenty-year outlook for zero-emission truck sales, market penetration, battery demand, fuel cell demand, and market value, with separate forecasts for medium and heavy-duty trucks. To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/trucks. |